- Insurance

9 Ways Insurance Carriers Are Driving Down Combined Ratios — with Video

Today’s insurance companies are in a difficult spot.

The rash of catastrophe incidents seemingly every year so far in the new millennium has forced carriers to revise CAT savings budgets upwards, putting new pressure on cost management.

For property and casualty carriers, the e-commerce success of a number of direct writers upended the traditional independent and captive agent channels alike, pushing large and storied organizations to either compete for smaller markets or make significant, difficult business changes to chase profitability.

Meanwhile, health insurance organizations in the US have been tasked with responding to the new business climate created by the Affordable Care Act — not least of which has meant monitoring every last legal battle for each and every change to what is or is not supported.

As a whole, the agency channel as a demographic continues to age — making continuity a concern and opening the door to a new wave of agency networks and consolidators rapidly reshaping the face of the insurance agency business.

And all that is on top of an already exceptionally complex, often arcane system of regulatory bodies, legal precedent, and governmental oversight.

The insurance industry provides a product that is absolutely essential to helping people recover in the event of an injury or loss. But thanks in part to all that oversight, all those requirements, and the massive cost of change at scale, rare is the individual who considers their insurance policy an engaging read.

Costs rising. Workforce aging. Brands muddled by political red tape. In the face of all that, insurance carriers need a tool they can use to gain an edge — to create an advantage in market designed to make it hard to set one’s self apart.

And for a growing number of insurers, video is that tool.

How Insurance Carriers Are Using Video To Gain Market Advantage

1. Documenting Claims

Why rely on static images or text descriptions when a rich, detailed video can be shot with the phone in almost anyone’s pocket? Already insurers are exploring the options for capturing claims information via video, either directly from the claimant through a new wave of smartphone apps, or later, from the adjuster — who often finds that even simple point-of-view video shot with a tablet, smartphone, or wearable camera like Google Glass provides a more complete summary of a claim activity than even the most detailed notes.

2. Capturing Employee Expertise

As insurance carriers seek to optimize products in ways that assign the right rate to the right risk, and navigate the increasingly convoluted waters of state-by-state insurance regulation as they do so, more and more daily work inside just about any insurer is now done by specialists. Relying on these experts helps insurance organizations find new ways to build more accurate ratings systems and identify opportunities for improving processes that others may miss. But that expertise comes with a dilemma — lose that specialist, and you may well lose the only working knowledge of how an integral component of the company operates.

In an industry with an aging workforce, capturing institutional expertise is quickly becoming essential to continued operations. As the New York Times has noted, many organizations are turning to video to help ensure that critical knowledge is always available inside the organization — even if the expert isn’t. Video makes it easy for insurers to ask internal experts to document their knowledge — showing how a ratings engine works, what factors are included in a coverage matrix, the standard workflow for the claims organizations, the step-by-step user interface for a proposed ecommerce design update, or virtually any other subject. Capturing these explanations with video and sharing them on a central internal video library allows anyone else in the organization to instantly find and reference them — so your expertise doesn’t walk out the door with your experts.

Watch how Panopto uses video to preserve institutional expertise in the video below:

3. Scaling Training — Efficiently Perhaps more so than any other industry, ongoing training is central to the insurance industry. Be it compliance training to meet industry regulations, technical training on new aspects of a product or business unit, personnel development courses for individual contributors, managers, or executives, sales training for agents or channel managers, or just simple tutorials on office productivity tools, training is an essential part of helping insurers remain competitive — and up to date in a constantly changing marketplace.

Perhaps more so than any other industry, ongoing training is central to the insurance industry. Be it compliance training to meet industry regulations, technical training on new aspects of a product or business unit, personnel development courses for individual contributors, managers, or executives, sales training for agents or channel managers, or just simple tutorials on office productivity tools, training is an essential part of helping insurers remain competitive — and up to date in a constantly changing marketplace.

Yet in a world where expense ratios are always a top concern, corporate learning and development can often be a target for cost-cutting. So how can today’s trainers help meet the always-growing needs of learners inside the organization without going over-budget?

Video offers a solution. Recording traditional classroom training events and sharing them online reduces the need to repeat those sessions time and again at multiple locations — with savings that speak for themselves. After finding that up to 40% of its classroom training costs were spent on travel and lodging, IBM moved half of its training programs to an eLearning format, saving more than $500 million in just 2 years. Microsoft too has found that adopting video as a key means to deliver training content dropped the cost per student of training sessions from $350 to a mere $17. In an industry where success is determined by a few decimal points in a combined ratio, those savings are no small matter.

Further still, the potential savings from video-enabled training doesn’t stop at cost alone. With a reduced travel schedule, corporate learning and development teams can more easily scale up their content, and share more training materials than ever before — all secure and shareable, and accessible 24/7 for employees to watch anywhere on any device.

Watch how video-based training can be used to scale compliance training in the example below:

4. Cross-Departmental Knowledge Sharing

The nature of business at most insurance organizations is one that leads to fairly separated working teams. Often, claims will be a wholly separate business unit from underwriting, which is in turn wholly separate from product development, and again apart from support functions like IT, HR, and marketing. And all that means when one team has a question for another, often the answers are not readily available.

In the past, insurers have relied on individuals to bridge that gap — either by going through official management communications chains, or by making personal connections that could then be tapped for insight. Video offers the opportunity to change all that. Today’s insurers are asking employees to use video to document standard working operations and business decision rationales, and storing those recordings in a central video library. This way, teams all across the organization have instant, anytime access to the inner workings of each part of the company — helping everyone to better understand the function each role plays, how each department can and should be involved in any new project, and who the right team members are to involve as new processes and programs are considered, to ensure the organization moves forward cohesively.

5. Broadcasting Consistent Channel Communications

As the insurance marketplace continues to fragment and evolve, carriers of all stripes have been challenged to find an effective tool for communicating with the front lines. Carriers relying on captive agents must find a way to deliver a consistent message to agents in thousands of small offices spread across the country and often around the world. Those relying on independent agents face a similar problem — made even more challenging, as the average independent agent works with 10 or more carriers. The need to ensure a message is delivered consistently and professionally is paramount.

In such an environment, video is an easy solution. A modern video platform like Panopto makes it simple to broadcast a message to a large number of agents at one, with live streaming webcasts. Unlike standard webinars that may only reach 100-1000 viewers at a time, webcasts can be viewed live by tens of thousands of people worldwide — and can be made instantly shareable on-demand the moment they are finished.

Learn how live webcasting works with Panopto by watching the video below:

6. Marketing Communications That Make A Difference

Often when one thinks of video and marketing, the traditional 30-second TV ad jumps to mind. Today’s insurance carriers have proven no amateur when it comes to video advertising — some of today’s best, most recognizable spots bear the logo of an insurance company. But ads are just scratching the surface of how savvy insurance marketing teams can use video.

For targeting leads at the top of the funnel, marketers can rely on a video platform to help extend the reach of those television ads — making them easy for customers to watch and share on their own all across the web. As prospects move down the funnel and begin the buying process, many marketing teams have found that offering a series of product explainer videos or recorded responses to FAQs engage new leads in a way that 20-page brochures simply don’t. The numbers bear it out — up to 85% of people are more likely to buy a product if they saw an explainer video first.

And the process doesn’t stop once the prospect becomes a customer. As today’s insurance organizations take serious steps toward building retention rates, many find that using video to create generic welcome and onboarding messages for new customers — walking through what’s in a policy document, how to sign up for web service, which phone numbers to call for claims, and other practical essentials — helps ensure customers feel taken care of as part of the buying process.

7. Internal Corporate Communications That Command Attention

Many of today’s insurance carriers are big companies — with big communications needs. Benefits, quarterly business updates, organizational news and announcements, training schedules, investor calls, messages from the CEO, and dozens of other subjects routinely call for the attention of your employees. For many insurers, it’s a tough task just to schedule all those internal communications activities — and that a growing number of employees just don’t seem to have time to read them all.

Video can help internal communications messages break through — in an engaging format that employees will notice. Forrester Research reports that employees are 75% more likely to watch a video than to read a message in text. And not only does video help encourage more of your team members to see your message — it helps you see who’s not paying attention. With video analytics included, modern video platforms like Panopto make it a snap to see exactly who has or hasn’t watched a given recording, as well as whether each viewer watched the video in full or stopped short.

See how your executive communications videos could look in Panopto:

8. Facilitating Legal eDiscovery

It’s a litigious world, and modern insurance organizations often bear the brunt. Be it complaints about a claim, a coverage, or a company’s compliance with regulations, most insurers are served with new lawsuits at an almost-daily pace.

eDiscovery has been a boon for most legal professionals in the insurance space — as documents are made digital, researching the exact wording of a policy in question requires little more than a quick search.Video, however, has changed all that. Without the ability to search the actual content of a video, legal professionals are forced to simply sit and watch all recorded content to ensure nothing improper has been communicated. It’s a long process — and gets expensive in a hurry.

But a new wave of video technology is changing all that. With Panopto, companies can search the actual content inside their videos. For every video in an organization’s video library, Panopto indexes every word spoken, every word that appears on-screen, and every word that is included in presentation slides — even speaker’s notes. With Panopto, eDiscovery is easy again — even for video content.

See Panopto’s video Smart Search in action:

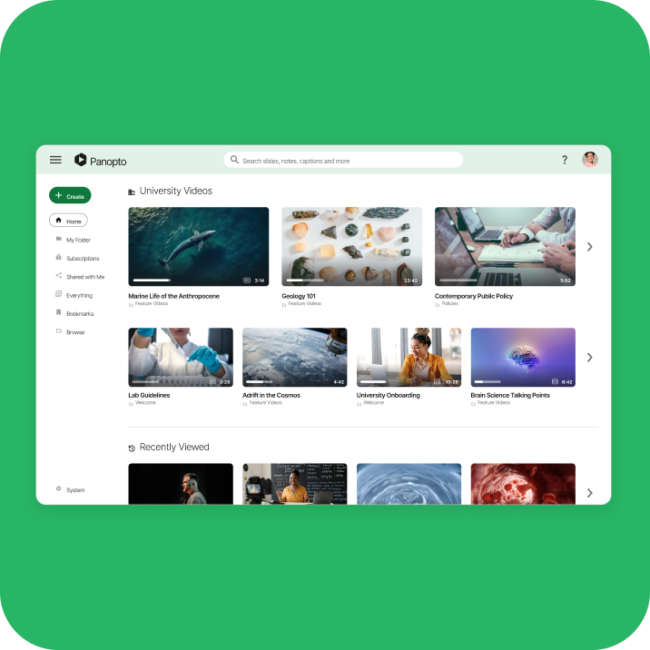

9. Maintaining a Central, Secure Library of Video Assets

No matter how any insurance carrier uses video most often, in the end, nearly every one creates a robust library of video files in the process. Panopto is the only video platform that integrates best-of-breed recording and webcasting with a secure video library. All of your Panopto recordings and live webcasts are automatically uploaded into the library and converted for optimal viewing on any computer, tablet, or smartphone. Pre-recorded videos can also be uploaded and converted for playback on any device.

And as the video library grows, Panopto provides a unique video search engine that makes finding information inside your videos as easy as searching for content within email and documents. Simply enter a phrase or world like “Compliance” into Panopto’s video search engine – you’ll find every relevant recording in your collection and be able to fast-forward to each point in your videos where the term is mentioned (click here to try the search yourself). Not only can comprehensive video search help your people find what they were looking for more quickly — it can also help them find recordings they didn’t even know existed.

Explore Panopto’s video content management system in the video below:

Try Panopto For Yourself!

Panopto is a video platform that enables you to incorporate multimedia presentations, live broadcasts, and other video content into your communication, documentation, and training strategies, helping your technology organization operate smarter, act more productively, and scale more efficiently.

To learn more about how you can use video in your technology company, contact our team to request a free trial of our video software today!